A customized solution developed by us in wake of the growing exposure for Inventory funding by Banks.

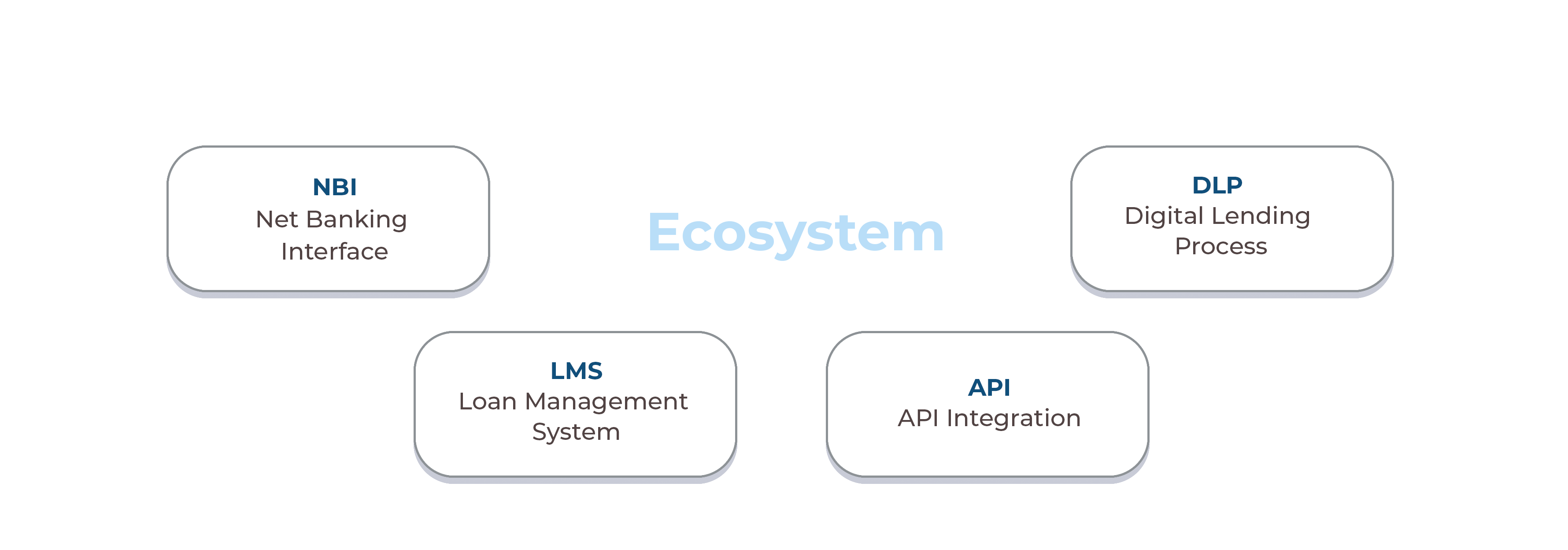

It is a web-based solution to facilitate & manage financial transactions related to dealers & Manufacturers integrated with existing core banking solutions & net banking interface.

Manufactures / Anchor can be set up in IFS system with limit allocations primarily to different categories and subcategories of the product market segment that the anchor is in the business of

these limits in turn are allocated to different dealers based on their cash flow requirements which can further be sub-allocated to regional or operational zones of the dealers for better monitoring and control.

![]() Improved cash flow: Inventory funding system provides businesses with the necessary capital to purchase inventory without depleting their cash reserves.

Improved cash flow: Inventory funding system provides businesses with the necessary capital to purchase inventory without depleting their cash reserves.

![]() Increased inventory levels: With inventory funding in place, businesses have the ability to increase their inventory levels, ensuring they can meet customer demand without facing stockouts or delays.

Increased inventory levels: With inventory funding in place, businesses have the ability to increase their inventory levels, ensuring they can meet customer demand without facing stockouts or delays.

![]() Flexibility in supplier negotiations: Having access to inventory financing enables businesses to negotiate more effectively with suppliers.

Flexibility in supplier negotiations: Having access to inventory financing enables businesses to negotiate more effectively with suppliers.

![]() Enhanced sales and revenue: Adequate inventory levels supported by an inventory funding system enable businesses to fulfill customer orders quickly and reliably.

Enhanced sales and revenue: Adequate inventory levels supported by an inventory funding system enable businesses to fulfill customer orders quickly and reliably.

![]() Minimized holding costs: Inventory funding systems allow businesses to minimize holding costs associated with excess inventory.

Minimized holding costs: Inventory funding systems allow businesses to minimize holding costs associated with excess inventory.

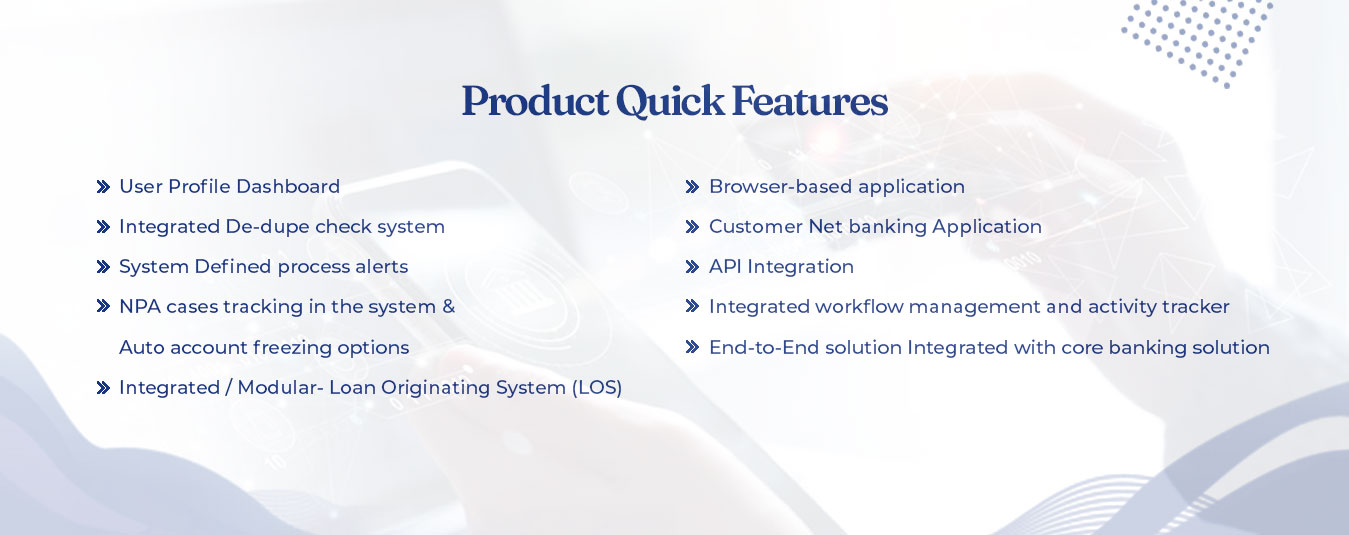

Master Maintenance

Disbursement Loan

MIS Dashboard

Support Module

NPA Management

Repayment Module

DrawDown & Repayment Reversal

Anchor/Vendor/

Dealer Onboarding