Account sourcing

Account monitoring

Control with M2M tools

Recovery management

Audit and loan closure

Document management

Integration with MultiBureau credit platforms

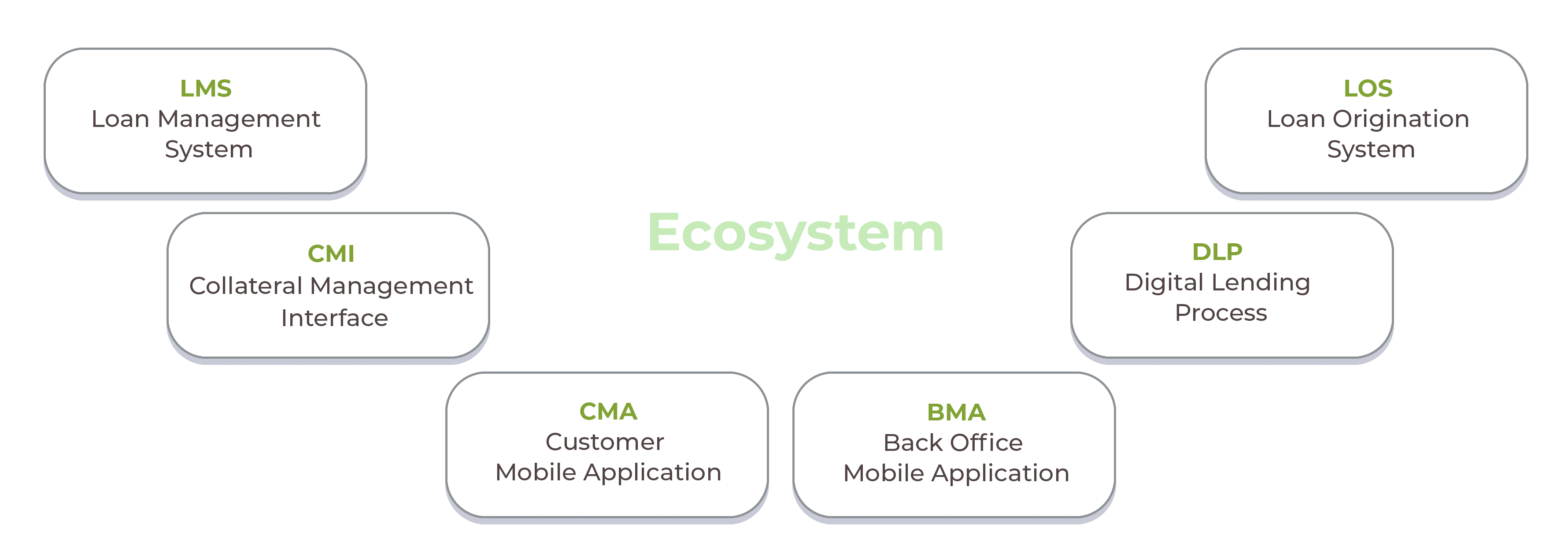

Collateral management interface

Customer mobile application

Banker back office mobile application

![]() Efficient & Scalable : Ability to manage bigger portfolios in commodity financing & lower TAT can be maintained for disbursals.

Efficient & Scalable : Ability to manage bigger portfolios in commodity financing & lower TAT can be maintained for disbursals.

![]() Real Time Monitoring : Allow banks to make real-time decisions on various levels of exposures, banks can monitor the risk involved throughout the contract period.

Real Time Monitoring : Allow banks to make real-time decisions on various levels of exposures, banks can monitor the risk involved throughout the contract period.

![]() Streamlined Operations : Various processes can be simplified across various locations using single application interface.

Streamlined Operations : Various processes can be simplified across various locations using single application interface.

![]() Centralized System : Operations can be simplified across various locations using single application interface.

Centralized System : Operations can be simplified across various locations using single application interface.

![]() Comprehensive Solution : End to end system which allows integration of margin call (mark to market) and tracking from a centralised location across the portfolio, integration with core banking and integrated document and warehouse receipt management.

Comprehensive Solution : End to end system which allows integration of margin call (mark to market) and tracking from a centralised location across the portfolio, integration with core banking and integrated document and warehouse receipt management.

![]() Transparency : Physical stock reconciliation allows banks to monitor stocks across all warehouses on real time basis.

Transparency : Physical stock reconciliation allows banks to monitor stocks across all warehouses on real time basis.

![]() Portfolio Risk Evaluation : Better view on the commodity price trends allows banks to quantify the value at risk on real time basis.

Portfolio Risk Evaluation : Better view on the commodity price trends allows banks to quantify the value at risk on real time basis.

Master

Maintenance

Commodity

Setup

Loan

Origination

Valuation/

Disbursement

Insurance

Tracker

MIS

Dashboard

Warehouse

Management

Mark to Market -

Margin Call System

Collection Management

API

Integration

Collateral Management

Support

Module